Why Most Budgets Fail.

If you’ve ever said, “I’m going to start budgeting this month”—only to give up a week later—you’re not alone. The problem isn’t that you lack discipline. It’s that most people pick a budgeting method that doesn’t actually fit their lifestyle.

The good news? There’s no “one-size-fits-all.” There are multiple budgeting frameworks designed for different personalities, income levels, and financial goals. Today, we’ll break down five of the most beginner-friendly methods so you can choose the one that works best for you.

1. The 50/30/20 Method

How it works:

-

50% of income → Needs (housing, utilities, food)

-

30% → Wants (dining, shopping, entertainment)

-

20% → Savings, investments & debt payoff

Best for: People who want a simple, flexible system that doesn’t track every dollar.

Watch out for: Lifestyle creep—if “wants” expand too much, savings shrink.

2. Zero-Based Budgeting

How it works: Every single dollar has a job. Income minus expenses = zero. If you earn $3,000, every penny gets assigned (bills, savings, investments, even “fun money”).

Best for: People who love control and detail. Perfect if you want to pay off debt aggressively.

Watch out for: Can feel overwhelming without a planner or app to track it.

3. The Envelope System

How it works: You set up envelopes (physical or digital) for categories (groceries, gas, dining out). Once the envelope is empty, you stop spending.

Best for: Visual learners or overspenders who need hard limits.

Watch out for: Less practical in a cashless, digital-first world—unless adapted to digital “envelopes.”

4. Pay Yourself First

How it works: Instead of saving what’s left over, you save first. A percentage (say, 15%) goes straight to savings or investments before you spend a dime.

Best for: People who want to grow savings automatically and don’t like micromanaging.

Watch out for: Easy to overspend what’s left if you don’t still track expenses.

5. The 80/20 Rule (a.k.a. The Pareto Budget)

How it works: 20% of income → Savings, debt payoff, investments. 80% → Everything else.

Best for: Minimalists who want a super simple rule.

Watch out for: Lack of detail may cause overspending in certain categories.

How to Choose the Best Method for You

The right method depends on your personality + financial situation:

-

Like structure? → Zero-Based Budgeting

-

Want flexibility? → 50/30/20

-

Overspend easily? → Envelope System

-

Hate tracking? → Pay Yourself First or 80/20

Common Mistakes to Avoid

Switching methods every month → leads to confusion

Forgetting to account for irregular expenses (holidays, car repairs)

Not tracking progress → budgeting without feedback = blind spending

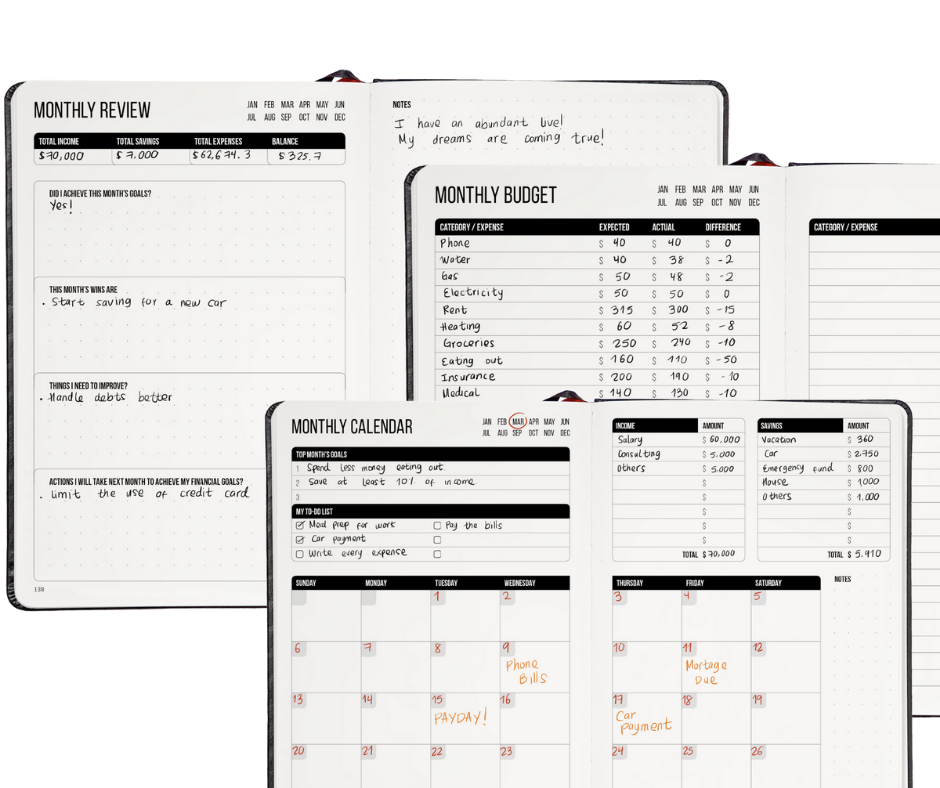

How the Budget Planner Helps

The ThisIsMyEra Budget Planner was built to adapt to all five methods. With flexible monthly spreads and trackers, you can:

-

Assign categories (envelope style)

-

Track every dollar (zero-based)

-

Build in percentages (50/30/20 or 80/20)

-

Automate savings (pay yourself first)

Your Budget, Your Rules

Budgeting isn’t about restriction—it’s about freedom. Once you find a method that matches your lifestyle, you’ll finally feel in control of your money.

So here’s your action step: pick one of these five methods and try it for 30 days. And grab the Budget Planner to make it stick.

Your financial freedom starts with your first budget—and it’s never been easier to begin.

-

A: Yes! For example, many people use 50/30/20 as a baseline but also pay themselves first.